The Budget Diaries: Early 20’s Money

Welcome to The Budget Diaries! The Budget Diaries pays homage to some of my favorite blog post series, the Money Diaries of Refinery29 and Cosmopolitan Magazine. In this series, I’ll be interviewing fellow bloggers about their budgeting habits, giving us a small peek into their financial lives. This week, we’ll be interviewing Dan, a personal finance blogger at Early 20’s Money, a blog focused on helping people in their early 20’s to achieve their financial goals.

Hi, thank you for agreeing to this interview! Will you tell us a bit about yourself?

My name is Dan and I’m a young adult who started the site Early 20’s Money in order to help those in their early 20’s with personal finance. Both my educational and work background are in engineering. I’m from Toronto, Canada, and am a huge sports fan!

Do you keep a consistent budget?

Yes, I make a monthly budget, and have been since 2016! I kinda started it as a project to “self-teach” Excel skills, and I chose a budget because I felt making one was long overdue. I have more of a “loose” budget though… I don’t vigorously follow it to the penny, but it gives me a general sense of accountability as well as knowing where my money is going. It is a zero-based budget, meaning I want to see a big 0 at the end every month! If it’s under 0 that means I overspent, and over zero means I underspent! Basically:

Income – Fixed Expenses – Money Invested – Variable Expenses = Zero

My fixed costs include my monthly bills. Fuel costs and food spending are often variable, but to make my life easy I consider them “fixed” based on taking an average of previous months. I also include pre-set contributions to my investments as a “fixed cost” of sorts, because I want to pay myself first! Everything else is a variable cost, which is what I really wanted to keep track of… How I spend my money after all the bills have been [paid]!

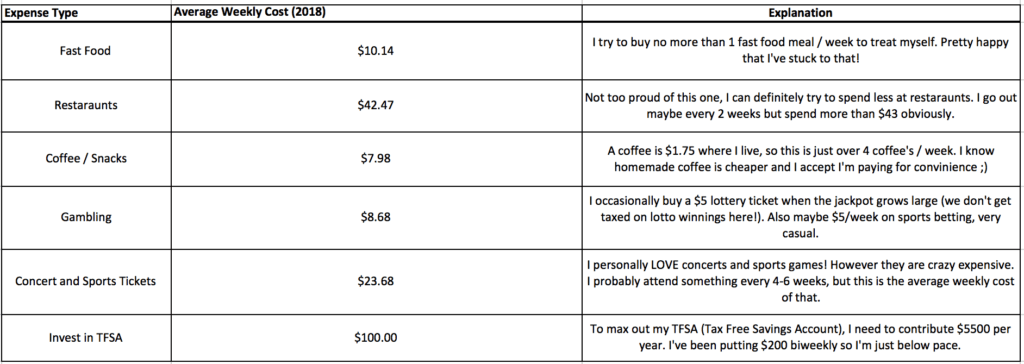

What’s a typical week of expenses for you?

Hmm, tough question. It’s hard to account for monthly bills (insurance, cellphone bill, etc.) on a week-to-week basis so I’ll leave those out. I copied/pasted some select categories from my budget spreadsheet that I feel are significant, so you can have more an idea where my “disposable” money goes! This is what I like to spend on after making ends meet.

What do you think is the hardest thing about budgeting?

To me, the hardest thing about budgeting is staying consistent with it. Keeping track of all your costs can be annoying, even with all the apps out there designed to help you (they can often mis-categorize your spending). I personally go every few days into Excel and track everything. I’m somewhat of a numbers geek and don’t mind doing this stuff, but I understand the idea of budgeting is not appealing to many.

What advice can you give to anyone who’s interested in budgeting?

Just Get Started! Don’t wait until the start of next month. Start tracking your expenses right now, even if it gives you an incomplete month of data… this can be your “practice month” Then, on the first day of the next month, you can start for real! Also, only go into as much detail as you’d like. More detail = more insight into your spending, but also more work.

For example, under the category “Food”, I have the subcategories Fast Food, Restaurants, Groceries, and snacks/coffee. If that is too much of a hassle, you can just simplify it to groceries and eating out. Much easier! Finally, if the word ‘Budget’ stresses you out, then try something easier… simply try to keep track of your expenses, without setting actual spending targets. This will still have the [effect] of making you more accountable. It’s kinda like writing a journal of what you eat when trying to lose weight.

Anything to say to our dear readers?

If you are reading this, I have to say that you are so great for trying to take charge of your finances, instead of letting them take charge of you! 73% of Americans say money is the #1 cause of stress, and also 35% of relationship issues are directly finance-related. Those stats are crazy! But, I guarantee you that by taking charge of your money, you will not fall into those statistics. I only have 1 other thing: Invest, Invest, Invest! Your savings account does not cut it… it actually loses money in the long run.

If you want to get started investing, I personally think a passive ETF is a great option to look at; you indirectly own all the stocks in an ‘index’, which basically represents an area or segment of the stock market. An example would be the S&P 500, which includes the 500 biggest public companies in the USA! I’m not your financial advisor (nor am I anyone’s financial advisor) and you should do your own research since it is your own money. But, I think it’d be great to start your research right there!

Thank you so much and may you always lead a financially free life!

Thanks! I wish the same to you, and to everyone reading. 🙂

Follow Dan in his adventures at Early 20’s Money:

✨Blog✨

✨Twitter✨

✨Instagram✨

✨Facebook✨

✨Pinterest✨

If you want to check out the other posts in this series, take a look at this link right here.

Have something to share? If you’d like to be a part of this series, feel free to email me at write@thewisebudget.com! I’m looking forward to having you here!

No Comments